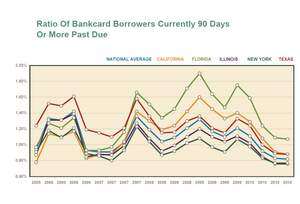

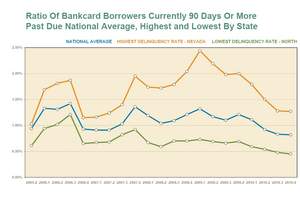

CHICAGO, IL--(Marketwire - February 22, 2011) - TransUnion's quarterly analysis of trends in the credit card industry revealed that the national credit card delinquency rate (the ratio of bankcard borrowers 90 days or more delinquent on one or more of their bank-issued credit cards) decreased to 0.82 percent in the fourth quarter of 2010, down almost 32 percent year over year. With the economic recovery in full swing, the decrease in the ratio of bank card borrowers delinquent has flattened out considerably; compared to last quarter, credit card delinquencies edged downward by only 1.2 percent.

Q4 2010 Credit Card Statistics

- The incidence of credit card delinquency was highest in Nevada (1.27 percent), followed by Mississippi (1.13 percent) and Florida (1.07 percent). The lowest credit card delinquency rates were found in North Dakota (0.45 percent), Alaska (0.54 percent) and South Dakota (0.55 percent).

- Thirteen states experienced an increase in credit card delinquency since last quarter. Leading the pack were Kansas (7.5 percent increase), Mississippi (6.6 percent increase) and Delaware (6.2 percent increase). The two areas of the country with the largest quarter-over-quarter drops in delinquency were the District of Columbia (-17.8 percent) and Montana (-16.7 percent).

- National average credit card borrower debt (defined as the aggregate balance on all bank-issued credit cards for an individual bankcard borrower) remained flat in the fourth quarter, increasing by only one dollar to $4,965 from the previous quarter's $4,964. On a year-over-year basis, average cardholder debt was down 8.62 percent.

- The highest state average credit card borrower debt remained in Alaska at $7,010, followed by North Carolina at $5,680 and Tennessee at $5,605.

- The lowest average credit card borrower debt was found in Iowa ($3,915), followed by North Dakota ($4,181) and South Dakota ($4,248).

- Thirty-three states showed an increase in average credit card borrower debt from the prior quarter. The largest increases in average credit card borrower debt over the previous quarter occurred in the District of Columbia (4.17 percent), Iowa (2.84 percent) and Mississippi (2.7 percent).

- On a year-over-year basis, national credit card originations increased by 19.1 percent. The fourth quarter of 2010 is the second consecutive quarter credit card originations increased since the recession began in late 2007. The increases occurred across the board, as all states showed upward movement in new credit card originations since this time last year. The states with the greatest year-over-year increases were Kentucky (41.1 percent), Nevada (34.3 percent), and Arizona (29.8 percent).

- Just as credit card delinquency trends can differ from the national to the state level, metropolitan areas can also show different credit dynamics relative to their respective state levels. Approximately half of the country's metropolitan statistical areas (MSAs) showed a quarter-over-quarter decrease in their 90-day credit card delinquency rates, as compared to 77 percent in the third quarter.

- The metropolitan area with the largest drop in delinquency over the quarter was Casper, WY (-57 percent). The metropolitan area with the largest increase in delinquency since last quarter was Lawrence, KS (82 percent).

U.S. Analysis and Supporting Quotes

"The fourth quarter now marks the second time since the recession officially ended in the summer of 2009 that average consumer credit card balances have not declined. However, on a year over year basis, these balances still show declines, but at a smaller rate when compared to recent history. It is encouraging to see a return to historical seasonality -- card balances would be expected to increase in the fourth quarter due to holiday spending.

"Taken together, the recent news on rising consumer spending, increased demand for durable goods, the drop in the personal savings rate, and increases in consumer confidence indicate that consumers may now be demonstrating a more optimistic view of their financial outlook -- possibly willing to expand their credit card use. Although TransUnion does not expect large increases in average credit card balances in the next couple of quarters due to the continuing high unemployment rates and the relatively high savings rate (now at 5.4 percent), the news is promising. It is a positive sign that consumers have more confidence in the increasing stability of the economy and of their own personal financial positions.

"From a delinquency perspective, 2010 was an excellent year for consumers as they showed continuing fiscal responsibility in working to pay down their credit card debt. Even in the presence of falling home prices, the accumulation of negative real estate equity and high levels of unemployment, consumers still have been placing a premium on paying off their credit card obligations and maintaining the health of their card relationships."

Ezra Becker, vice president of research and consulting in TransUnion's financial services business unit.

Forecast

- At the state level, Nevada is again expected to experience the highest delinquency rate by the end of 2011 (1.2 percent), while North Dakota is anticipated to show the lowest delinquency rate (0.39 percent).

"Since the beginning of the recession, TransUnion's national and state forecasting models have tracked how credit card delinquency rates are impacted by economic factors such as median household income, consumer confidence and the U.S. savings rate. Based on our current economic assumptions, TransUnion believes that the 90-day credit card delinquency rate will still be impacted by seasonal factors, but generally continue to drift downward toward 0.73 percent by the end of 2011."

Ezra Becker, vice president of research and consulting in TransUnion's financial services business unit.

Supporting Resources/Links

TransUnion Trend Data Interactive U.S. Map

TransUnion 3Q Mortgage Statistics

TransUnion Payment Hierarchy Study

TransUnion Value of Loyalty/Delinquency Study

TransUnion on Twitter

TransUnion's Trend Data database

The report is part of an ongoing series of quarterly consumer lending sector analyses focusing on credit card, auto loan and mortgage data available on TransUnion's Web site. Information for this analysis is culled from TransUnion's Trend Data and the anonymous credit files of approximately 10 percent of credit-active U.S. consumers, providing a real-life perspective on how they are managing their credit health.

TransUnion's Trend Data, a one-of-a-kind database consisting of 27 million anonymous consumer records randomly sampled every quarter from TransUnion's national consumer credit database. Each record contains more than 200 credit variables that illustrate consumer credit usage and performance. Since 1992, TransUnion has been aggregating this information at the county, Metropolitan Statistical Area (MSA), state and national levels. For the purpose of this analysis, the term "credit card" refers to those issued by banks.

About TransUnion

As a global leader in credit and information management, TransUnion creates advantages for millions of people around the world by gathering, analyzing and delivering information. For businesses, TransUnion helps improve efficiency, manage risk, reduce costs and increase revenue by delivering comprehensive data and advanced analytics and decisioning. For consumers, TransUnion provides the tools, resources and education to help manage their credit health and achieve their financial goals. Through these and other efforts, TransUnion is working to build stronger economies worldwide. Founded in 1968 and headquartered in Chicago, TransUnion employs associates in more than 25 countries on five continents. www.transunion.com/business

Contact Information:

Contact:

Dave Blumberg

TransUnion

E-mail:

Telephone: 312 985 3059