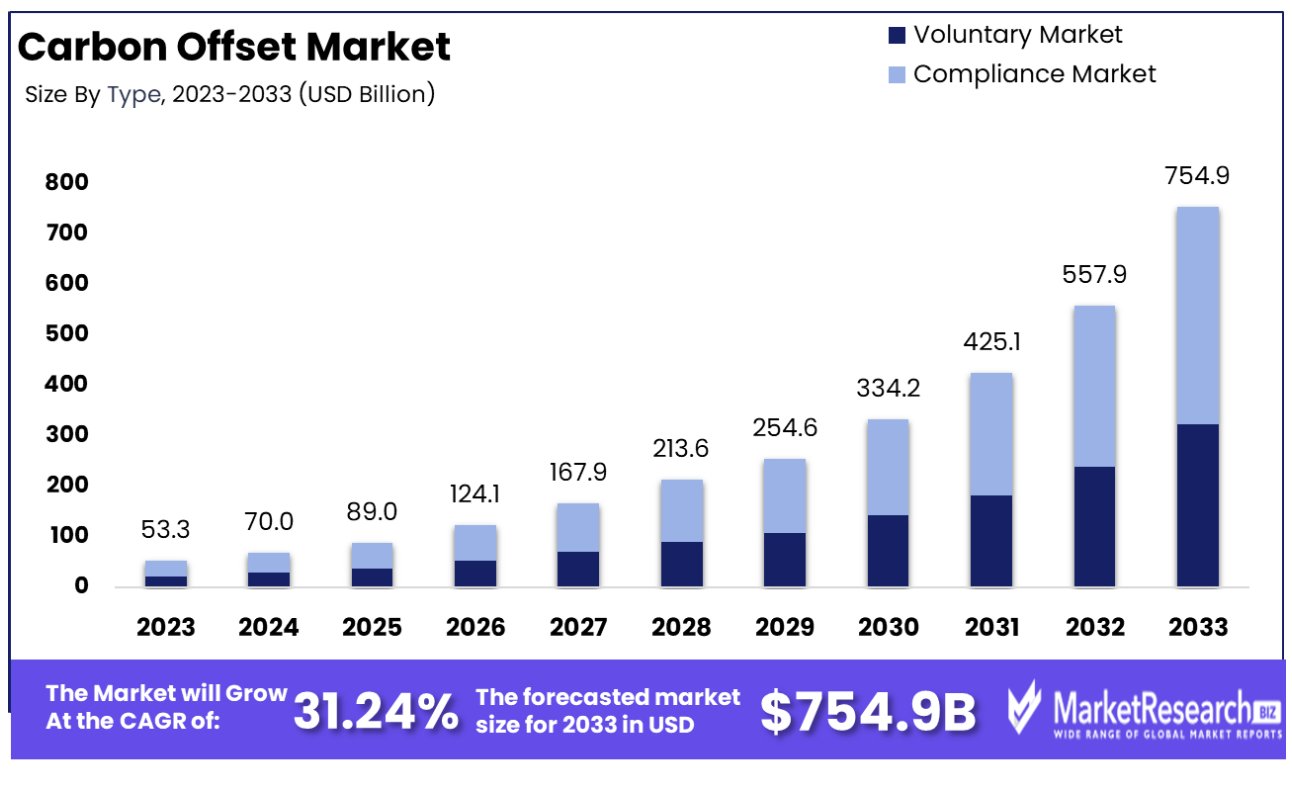

New York, Jan. 16, 2024 (GLOBE NEWSWIRE) -- The carbon offset market was valued at USD 53.3 billion in 2023 with a significant growth and is projected to reach at USD 754.9 billion by 2033 with an outstanding CAGR of 31.24%.

Carbon offsets, measured in metric tons of CO2e, provides a vital possibility for reducing climate change. Allied with regulatory frameworks, particularly the EU's determination emission decrease targets, they offer businesses and individuals a means to invest in environmental projects to reimburse for their emissions. The rise in global regulatory initiatives, along with corporations implementing net-zero targets, has compelled a substantial demand for credible carbon offsets.

Get additional highlights on major revenue-generating segments, Request a Carbon Offset Market sample report at https://marketresearch.biz/report/carbon-offset-market/request-sample/

In 2023, top businesses used 37.8 million carbon offsets, demonstrating 5% of the voluntary market credits over three years. As companies strive to meet climate goals, the market for effective offsets grows, presenting an opportunity for market expansion. New carbon-trading networks, personalized to localized actions, provide association and investment chances, answering to the demand for personalized offset solutions. Paraguay's recent law creating a carbon credit registry further improves transparency and organization in the market.

Incorporating carbon offsets into consumer choices taps into the increasing conscious consumerism trend. Businesses implanting offset options into consumer-facing platforms can attract environmentally aware customers, fostering growth and highlighting obligation to sustainability. Innovations like Building-Integrated Photovoltaics contribute to offset goals by producing renewable energy and decreasing reliance on emissions-intensive power sources.

Key Takeaways

- The compliance market rules the type market segment due to regulatory mandates requiring companies to offset their carbon emissions.

- Avoidance or reduction project dominates the project type market segment as it prevents the carbon emissions or reducing existing emissions.

- The energy sector leads the end-use market segment due to carbon offset projects that comprises of transitioning to renewable energy and implementing carbon capture and storage solutions.

- North America leads the global carbon offset market with a 31% share, compelled by strong climate change initiatives and corporate responsibility.

Driving Factors

Corporate Carbon Goals Compels the Market Growth

More companies commit to reducing their carbon footprint, the demand for carbon offsets as a tool to achieve these goals increases. Businesses are utilizing carbon offsets to compensate for emissions they cannot eliminate through direct actions. According to the United Nations, more than 9,000 companies, over 1,000 cities, more than 1,000 educational institutions, and over 600 investors have committed to achieving a solution to net-zero emissions by 2050. The commitment to carbon neutrality and net zero targets by a growing number of corporations suggests a continued expansion of the carbon offset market, underpinned by corporate efforts to address climate change.

Regulatory & Government Policies

These regulations often include mechanisms like cap-and-trade systems or carbon taxes that incentivize or mandate the use of carbon offsets. Governments worldwide are implementing policies that require or encourage carbon offsetting as part of broader climate change and sustainability initiatives. This regulatory environment not only promotes the growth of the carbon offset market but also ensures its integration into national and international climate strategies. These regulations often include mechanisms like cap-and-trade systems or carbon taxes that incentivize or mandate the use of carbon offsets.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://marketresearch.biz/report/carbon-offset-market/#inquiry

Restraining Factors

Absence of Preparation for New Market Mechanisms Limits

Many regions and organizations are unprepared for this transition, lacking the necessary infrastructure, legal frameworks, or technical expertise. This unpreparedness can delay the establishment and efficient functioning of carbon markets, limiting the ability to scale up and attract broader participation. By leveraging advanced algorithms and predictive models, generative AI can play a crucial role in streamlining and optimizing the intricate processes involved in carbon trading.

Have Queries? Speak to an expert or To Download/Request a Sample, Click here.

Report Scope

| Report Attribute | Details |

| Market Value (2023) | US$ 53.3 Billion |

| Market Size (2033) | US$ 754.9 Billion |

| CAGR (from 2024 to 2033) | 31.24% from 2024 to 2033 |

| North America Region Revenue Share | 31% |

| Historic Period | 2016 to 2023 |

| Base Year | 2023 |

| Forecast Year | 2024 to 2033 |

Growth Opportunities

Increase in Carbon Capture Investments

Carbon capture technologies play a critical role in reducing atmospheric CO2, and their advancement directly increases the availability and efficacy of carbon offset projects. Businesses and governments invest more in carbon capture and storage (CCS) technologies, the capacity to offset larger volumes of carbon emissions expands. This investment is a response to the growing demand for effective solutions to mitigate the impact of climate change. The ongoing investment in these technologies suggests a future where carbon offsets become an integral part of global climate strategies, indicating sustained growth in the market driven by technological advancements in carbon capture.

Regional Analysis

North America leads the global carbon offset market with a 31% share, compelled by strong climate change initiatives and corporate responsibility. Policy support and consumer demand for sustainability underwrite to the market's growth. Europe, a forerunner in climate action, sees expansion through the EU Emissions Trading System. In Asia-Pacific, the market is emerging with rising environmental consciousness, renewable energy investments, and considerable potential for growth.

Grow your profit margin with Marketresearch.biz - Purchase This Premium Report at https://marketresearch.biz/purchase-report/?report_id=42699

Segment Analysis

By type, the compliance market rules the market segment due to regulatory mandates requiring companies to offset their carbon emissions. This segment's dominance is underpinned by government-imposed carbon reduction targets and cap-and-trade schemes, where entities must purchase carbon credits to comply with emission caps. It is important in industries like energy, manufacturing, and transportation, where emissions are customarily high. This market is characterized by a more formal and regulated structure, offering standardized and verified carbon credits.

By project, avoidance or reduction project dominates the market segment as it prevents the carbon emissions or reducing existing emissions. The popularity of these projects lies in their immediate impact on reducing emissions and their alignment with sustainable development goals. These projects include renewable energy initiatives, energy efficiency improvements, and methane capture. Removal or sequestration projects involve the capture and storage of carbon dioxide from the atmosphere.

By end-use, the energy sector leads the market segment due to carbon offset projects that comprises of transitioning to renewable energy, refining energy efficiency, and implementing carbon capture and storage solutions. The transportation sector is focusing on offsets through cleaner fuel initiatives and efficiency improvements. The aviation industry is increasingly investing in carbon offsets to mitigate its environmental impact.

For more insights on the historical and Forecast market data from 2016 to 2033 - download a sample report at https://marketresearch.biz/report/carbon-offset-market/request-sample/

Segments Covered in this Report

By Type

- Compliance Market

- Voluntary Market

By Project Type

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

By End-Use

- Energy

- Aviation

- Transportation

- Industrial Buildings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Competitive Landscape Analysis

Key players in the carbon offset market, such as South Pole Group and Climate Impact Partners, rules with varied portfolios in impactful projects. 3Degrees and EKI Energy Services provide to rising corporate demand for renewable energy credits and carbon management. NativeEnergy and CarbonBetter specialize in custom projects, while Carbon Care Asia and Terrapass focus on regional initiatives. Climetrek Ltd. and Carbon Credit Capital contribute to market trends assimilating technology and invest in climate action.

Key Market Players

- South Pole Group

- 3Degrees

- EKI Energy Services Ltd.

- NativeEnergy

- CarbonBetter

- Carbon Care Asia Limited

- Terrapass

- Climetrek Ltd.

- Carbon Credit Capital

- Climate Trade

- ForestCarbon

- Moss.Earth

- Bluesource LLC

- Climate Impact Partners

- Carbonfund

- Climeco LLC

Recent Developments

- In August 2023, Ora Technology, a software company, is focusing on creating a digital carbon trading platform called Ora Carbon. This platform is designed to revolutionize the voluntary carbon market by enabling users to buy, sell, and retire carbon credits. The primary goal of Ora Carbon is to provide easy access to carbon assets, simplifying the complex processes associated with the carbon industry.

- In August 2023, ICVCM released its long-awaited framework as part of its Core Carbon Principles (CCPs), setting higher standards for carbon credits in the voluntary carbon market (VCM).

- In 2023, Microsoft's contracted carbon removal increased significantly to almost 5 million metric tons in 2023 due to a substantial purchase from energy providers.

Browse More Related Reports

- Carbonyl Iron Powder Market size is expected to be worth around USD 1.3 Bn by 2032 from USD 0.9 Bn in 2022, growing at a CAGR of 4.10% during the forecast period from 2023 to 2032.

- Calcium Carbonate Market size is expected to be worth around USD 13.6 Bn by 2032 from USD 9.5 Bn in 2022, growing at a CAGR of 3.7% during the forecast period from 2023 to 2032.

- Hydrogen Stations Market size is predicted to reach approximately USD 3.7 Bn by 2032, from a valuation of USD 0.6 Bn in 2022, growing at a CAGR of 21.4% during the forecast period from 2023 to 2032.

- Photovoltaic Market size is predicted to reach approximately USD 218.9 Billion by 2032, from a valuation of USD 96.2 Billion in 2022, growing at a CAGR of 8.8% during the forecast period from 2023 to 2032.

About Us:

MarketResearch.Biz (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. MarketResearch.Biz provides customization to suit any specific or unique requirement and tailor-made reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn: https://www.linkedin.com/company/marketresearch-biz/

Follow Us on Facebook: https://www.facebook.com/marketresearch.biz

Follow Us on Twitter: https://twitter.com/PrudourResearch