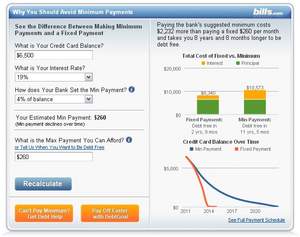

SAN MATEO, CA--(Marketwire - Apr 12, 2011) - Americans continue to hold high levels of credit card debt, with consumer money resource Bills.com estimating more than $2,500 of credit card debt for every man, woman and child in the United States as of January 2011(1). To help consumers better understand the time and money implications of paying off credit cards using only minimum payments, Bills.com today introduced the

Bills.com Launches New Minimum Credit Card Payments Calculator

Easy-to-Use Calculator Leverages Simple Language and Graphs to Demonstrate the Time and Money Advantages of Paying More Than Credit Card Monthly Minimums

| Source: Bills.com