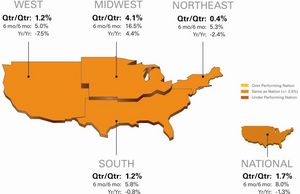

-- National / Four Region Overview: National quarterly price gains

remain positive (1.7%) this month, as did the Midwest (4.1%), South (1.2%),

West (1.2%), and Northeast (0.4%) regions. Yearly national home prices

rebounded from a dismal 2008 (-20.4% price change year-over-year) to post a

modest yearly price change of -1.3 percent in 2009. The national REO

saturation rate also dropped 16 percentage points from the beginning of the

year, to 25.5 percent at the release of this report.

-- Metropolitan Statistical Area (MSA) drilldown: Detroit, Mich.

followed up its strong performance last month to once again lead the

highest performing markets with a 17.4% gain. Overall, home prices continue

to improve with seven of the fifteen highest performing markets posting

positive yearly gains. Compare that to this time last year, when only one

market returned positive year-over-year marks.

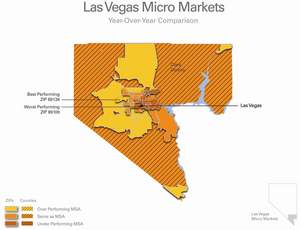

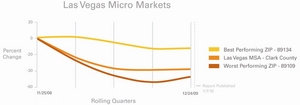

-- Micro Market Analysis: The Las Vegas, Nev. MSA turned in its first

positive quarterly price gain in more than three years (1.1%). While its

yearly price decline (-27.4%) is still high, Las Vegas is showing signs of

transitioning from home-price free-fall, to more traditional trends.

The Clear Capital HDI Market Report offers the industry, investors and

lenders a near real-time look at pricing conditions not only at the

national and metropolitan level, but within local markets. Clear Capital

data is built on the most recent data available from recorder/assessor

offices, and then further enhanced by adding the Company's proprietary

market data for the most comprehensive geographic coverage available.

"After watching home prices plummet the past three years, it is encouraging

to see the year close with minimal price declines," said Kevin Marshall,

Clear Capital President. "The stronger positive gains we saw this summer

have softened into the fall and early winter, but it's good to see that

they've remained in positive territory. It's remarkable that home prices

for the nation as a whole were generally flat for 2009, given this year's

volatility that included record declines early in the year, followed by the

gains of summer and fall."

National/Four Region Market Overview (Nov. 25, 2008 - Dec. 24, 2009)

As 2009 draws to a close, national price gains remained positive, returning

a 1.7 percent change this quarter. Regional quarterly results remained

positive as well, with the Midwest returning 4.1 percent gains, followed by

the South and West (1.2%), and Northeast (0.4%).

The financial turmoil that began this year has been replaced with a dose of

incentivized optimism. Homebuyer credits mixed with low interest rates have

helped return homebuyers to the marketplace. At the same time, loan

modification programs have helped regulate the new supply of distressed

properties. Throughout 2009, these factors contributed to the national REO

saturation rate dropping from 41.5 percent in the first quarter, to 25.5

percent at the release of this report. While remaining high by historic

standards, this downward swing in REO saturation helped drive prices up

during the summer months, stabilizing home prices from the -20.4 percent

yearly change experienced in 2008.

After sustaining early losses in the winter months of 2009, national home

prices rebounded to post a modest yearly price change of -1.3 percent.

Stronger summer gains, followed by continued, albeit softening, quarterly

gains in the fall and early winter helped make up most of the losses

sustained in the first quarter of this year.

Continued improvement from the double-digit yearly losses reported in all

regions earlier this year is clearly visible -- especially the Midwest

(4.4%) which experienced a positive bounce off earlier lows. Additionally,

the South closed in on positive yearly gains (-0.8%); the Northeast (-2.4%) was able to retain most of its value with improved gains the last half year; and even the more substantial losses in the West (-7.5%) were an improvement from the same time a year ago. Metro Markets (Nov. 25, 2008 - Dec. 24, 2009) This list of the highest performing major markets is quite an improvement over what the markets were experiencing at the end of 2008. All major markets from this month's list experienced positive quarterly price changes, averaging 5.7 percent. Detroit was once again this month's quarterly top performer with price gains of 17.4 percent. Detroit's market continues to be driven by REO sales (50.6%), where prices continue to rise from their steeply discounted levels of early 2009. Seven of the 15 markets posted positive yearly results as well. When you remove the 63.8 percent yearly gains of Cleveland, Ohio (which was subject to dramatic price shifts among its large REO segment), the remaining 14 markets averaged a nearly flat yearly return of -0.3 percent. Compared with this time last year, only one major market (Rochester, N.Y.) saw positive yearly price gains, and all of the highest performing markets were experiencing quarterly losses. Further, Atlanta Ga.; Minneapolis, Minn.; Phoenix Ariz.; Riverside, Calif.; San Francisco, Calif.; and San Jose, Calif.; all on this month's highest performing major market list, were among the lowest performing major markets one year ago. This volatility is largely a reflection of heightened REO influences that continues today. Such swings in price change have made it difficult for nearly everyone, from policy makers to banks and investors, to keep an accurate account of current trends. This has hindered the ability to set policy, adjust REO strategy, price collateral and/or judge the success of loan modification and moratorium programs. While heightened REO activity will continue into next year, the pause in price declines during the second half of 2009 has allowed all parties to gain perspective on current trends, and be better prepared for whatever the market brings in 2010. All markets on both the lowest and highest performing major market lists experienced improved yearly price changes compared to last month, with the exception of Baltimore, Md., which saw its yearly price change slightly drop another 0.1 percentage points to end up at -8.8 percent. Similarly, all markets saw REO saturation rates decline (generally considered an improvement) since last month, except for two -- Raleigh, N.C. and Columbus, Ohio. In contrast to the yearly improvements, quarterly prices softened, a continuation of the trend reported last month and a sign of the typically slower winter months. The larger quarterly declines in Milwaukee, Wis. and New Haven, Conn. were more closely aligned with the broader slowing reported last month, as heated summer sales were replaced by more muted sales of fall. However, the changes for all 15 of the lowest performing markets are modest compared to the summer run-up, and the declines have slowed compared to last month's report. With holiday foreclosure moratoriums and the extension of the homebuyer credit now secure, it's less likely a significant upwards swing in REO rates will occur next month. At the end of 2008, the fifteen lowest performing markets posted double-digit quarterly declines, and yearly declines between 20 and 40 percent. The dire straits experienced in 2008 are put into perspective when compared to the conditions at the end of 2009. As of this report, quarterly declines are now all less than four percent, and yearly price changes are a mix of modest gains and, except for Orlando, Fla. (-25.8%), sub-twenty percent losses. Micro Markets (Nov. 25, 2008 - Dec. 24, 2009) This section highlights a single market every month with a deeper dive into how the micro- and macro-markets relate to each other. After home prices peaked in mid 2006, Las Vegas saw its percentage of REO sales grow to dominate the market, easily surpassing the 50 percent mark by mid-2008. Las Vegas has seen few signs of hope as home prices have fallen 63.7 percent since their peak, and the city has faced oversupply from new construction and near-new construction re-entering the market as short sales and REOs. Today, while Las Vegas maintains a 53.3 percent REO saturation rate, home prices have flattened with the first quarterly price gain (1.1%) in more than three years. While still considered a distressed market (yearly price change of -27.4%), the transition of home prices from a free-fall to almost flat has been gradual over the past six months for the market in its entirety. The flattening of home declines was fueled by the attractiveness of reduced prices and an inventory shift to short sales. Short sales, generally less attractive to purchasers due to the complexities and timeframes of the process, have made the steeply discounted REOs more attractive to home buyers. While no micro market within the Las Vegas metropolitan area has seen yearly price declines better than ten percent, there are variations in loss severity throughout 2009. Just off the Las Vegas strip, ZIP 89109 was the hardest hit micro market, posting a yearly price change of -45.1 percent. This area suffered from a large supply of investor-driven condominiums (nearly three-out-of-four sales were REO) built just prior to the market's peak. The oversupply of condominiums, combined with limited financing options, prevented any sustained reduction of REO properties. The best performing micro market (ZIP 89134) lies northwest of downtown Las Vegas, in an attractive area west of Interstate 95 and north of Summerlin Parkway. While the area's 48.4 percent REO saturation rate is not considered healthy, it's largely free of the downtown condominium supplies, and since late 2008, has managed to slowly improve its REO picture. Composed largely of decade-old single family residences which many find attractive, this area saw prices change only -14.5 percent for the year -- the smallest loss among the Las Vegas metropolitan area. It will take some time for the REO saturation picture to improve for the greater Las Vegas area, and prices will continue to be subject to its influence. However, the home price stabilization experienced in 2009 improved the sellers' ability to move certain inventories, a hopeful sign that any future introductions of REOs to the marketplace might be better absorbed than in recent years. Clear Capital Home Data Index™ Methodology The Clear Capital Home Data Index (HDI) provides weighted paired sales, and price-per-square-foot index models that use multiple sale types, including single-family homes, multi-family homes and condominiums. These models are combined with an address-level cascade to provide sale-type-specific analysis for thousands of geographic areas across the country. The indices include both fair market and institutional (real estate owned) transactions. They also provide indicators of REO activity such as REO discount rates, REO days on market and REO saturation. The Clear Capital HDI generates indices in patent pending rolling quarter intervals that compare the most recent four months to the previous three months. The rolling quarters have no fixed start date and can be used to generate indices as data flows in, or at any arbitrary time period. About Clear Capital Clear Capital (www.clearcapital.com) is a premium provider of data and solutions for real estate asset valuation and risk assessment for large financial services companies. Our products include appraisals, broker-price opinions, property condition inspections, value reconciliations, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date and well documented valuation data and assessments. The Company's customers include 75 percent of the largest U.S. banks, investment firms and other financial organizations. Legend Address Level Cascade -- Provides the most granular market data available. From the subject property, progressively steps out from the smallest market to larger markets until data density and statistical confidence are sufficient to return a market trend. Home Data Index (HDI) -- Major intelligence offering that provides contextual data augmenting other, human-based valuation tools. Clear Capital's multi-model approach combines address-level accuracy with the most current proprietary home pricing data available. Metropolitan Statistical Area (MSA) -- Geographic entities defined by the U.S. Office of Management and Budget (OMB) for use by Federal statistical agencies in collecting, tabulating, and publishing Federal statistics. Paired Sales Model -- Weighted linear model based on repeat sales of same property over time. Price Per Square Foot (PPSF) Model -- Median price movement of sale prices divided by square footage over a period of time -- most commonly a quarter. Real Estate Owned (REO) Saturation -- Calculates the percentage of REOs sold as compared to all properties sold in the last rolling quarter. Rolling Quarters -- Patent pending rolling quarters compare the most recent four months to the previous three months. The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.

Contact Information: Media Contact: Michelle Sabolich Atomic PR for Clear Capital (415) 402-0230