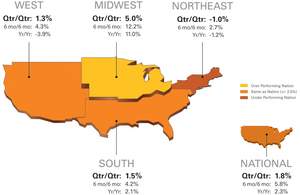

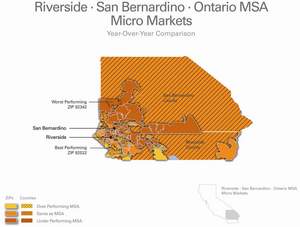

-- National / Four Region Overview: With the latest numbers in, national home prices continued to experience quarterly gains this month (1.8%), and for the first time in 37 months, posted national year-over-year gains of 2.3 percent. Regionally, the Midwest (5.0%), South (1.5%) and West (1.3%) all posted positive quarterly gains as well, with the Northeast posting a -1.0 percent quarterly price change. -- Metropolitan Statistical Area (MSA) drilldown: Severely distressed Detroit, Mich. led all markets once again, maintaining a 14.6 percent quarterly price change. Nine of the fifteen highest performing major markets saw quarterly prices improve over last month, and yearly price changes for all the highest performing markets improved by an average of 6.1 percent. -- Micro Market Analysis: The Riverside/San Bernardino/Ontario, Calif. MSA continues to show quarterly improvement (4.2% price change), and even localized yearly gains in certain heavily distressed micro markets.The Clear Capital HDI Market Report offers the industry, investors and lenders a timely look at pricing conditions, not only at the national and metropolitan level, but within local markets. Clear Capital data is built on the most recent data available from recorder/assessor offices, and then further enhanced by adding the Company's proprietary market data for the most comprehensive geographic coverage available. "It's great to see the year-over-year positive gain in national home prices continue into 2010 the pricing stability we saw the last half of 2009," said Dr. Alex Villacorta, Senior Statistician, Clear Capital. "The stabilization in prices is significant in that it has occurred despite near record levels of unemployment and REO saturation." "While it is a very positive sign that the overall national trends show yearly improvements in prices and REO saturation, market trend volatility and prices continue to vary considerably by micro market and price tier," said Villacorta. "The sustainability of current price gains will be challenged in 2010, given that most lenders and analysts predict a significantly larger number of REOs will reach the markets. Further, this suggests that as the dynamics of supply and demand evolve, different markets will have varied responses to increased REO activity." National/Four Region Market Overview (Jan. 2009 - Jan. 2010) Home prices across the nation experienced the eighth consecutive month of rolling quarter gains (1.8%), and for the first time since late 2006, posted national year-over-year gains of 2.3 percent. Regionally, the Midwest (5.0%), South (1.5%) and West (1.3%) all posted positive quarterly gains as well, with the Northeast being the exception, posting a -1.0 percent quarterly price change. Despite the Northeast's modest quarterly slowdown, all regions improved their yearly numbers which contributed to the nation's yearly gains. The Midwest continues to lead the nation in year-over-year returns, posting prices 11.0 percent higher than a year ago. These gains reflect the improved conditions off the significant lows of last year. The impact of the Midwest's current positive results is moderated by the -13.0 percent quarterly price change experienced this time last year. The national Real Estate Owned (REO) saturation rate declined 0.7 percentage points to 24.8 percent this month compared to last month. However, an interesting trend has developed over the past few months in regions with the highest level of REO influence. Recovery of home prices has generally been more notable in the regions with the highest level of REO saturation. This is apparent with the higher levels of REO saturation experienced in the West (35.4%) and Midwest (28.4%). While the rise in prices within REO-saturated markets runs counter to traditional expectations (higher rates of REO saturation usually creates downward price pressures), it's a reflection of the broad appetite for the steeply discounted REO segment. Increased REO activity in 2010 will test investor appetite for distressed sales. Metro Markets (Jan. 2009 - Jan. 2010) Quarterly price gains in the highest performing major markets fluctuated only slightly this month, while yearly price gains continue to grow. Once again, Detroit, Mich. led all markets maintaining a substantial 14.6 percent quarterly price change. Detroit's price change did continue to soften, however, dropping 2.8 percent from last month. Nine of the fifteen markets saw quarterly prices improve this month, allowing all to improve yearly price changes by an average of 6.1 percent compared to last month's report. Only the Florida markets of Jacksonville and Miami, and Riverside, Calif. maintained yearly losses. However, the recent improvement for all three markets has them headed toward positive territory for the year -- possibly within a month's time if gains manage to continue into mid-winter. It's worth noting though, that if these two Florida markets continue to see their condominium segments deteriorate (starkly contrasting the gains of single family properties), their overall home price recovery could be slowed down. The home price improvements on the list continue to reflect declines in REO saturation, which were seen in twelve of the fifteen markets. St. Louis, Mo. experienced the greatest decline in saturation with a 4.9 percentage point drop from last month. St. Louis also saw the largest quarterly price improvement, jumping from a price change of -0.2 percent last month to 5.2 percent this month. Only the MSAs for Atlanta, Ga., Cleveland, Ohio, and Oklahoma City, Okla. experienced modest gains (less than 1.0%) in REO saturation rates. In addition to Riverside, the state of California -- one of the most adversely affected states -- now retains a strong presence on highest performing market list with a total of four major markets included. With the exception of Birmingham, Ala., all of the lowest performing major markets saw their quarterly prices degrade this month. The list is far from bleak compared to recent years, however, with year-over-year numbers continuing to improve for nearly the entire list. Only Dallas, Texas and Pittsburgh, Pa. saw yearly prices deteriorate this month. Six markets on this list experienced positive yearly gains; and eight markets saw single digit declines, of which Richmond, Va. (-0.5%) and Dallas (-0.1%) posted generally flat yearly results. Orlando, Fla. remains the only market on the list with a double-digit negative yearly price change (-21.4%), as it continues to experience a negative impact from elevated REO influences (40.8% REO saturation rate) -- particularly amidst its condominium segment. REO saturation rates for the lowest performing markets as a whole remained flat this month with an average decline in the saturation rate of only 0.1 percent. Interestingly, this average is comprised of a nearly even split, with eight of the markets showing slight declines in saturation and the remaining seven increasing in REO saturation. No single market saw saturation rates swing by more than 2.7 percent, and only three markets (Columbus, Ohio; Rochester, N.Y.; and Seattle, Wash.) saw rates increase by more than one percent. Micro Markets (Jan. 2009 - Jan. 2010) This section highlights a single market every month with a deeper dive into how the micro- and macro-markets relate to each other. The Riverside/San Bernardino/Ontario MSA has been one of the lowest performing markets over the past few years, experiencing a price change of -61.1 percent since prices peaked in mid-2006. With fair access to both buildable land and the population centers of southern California, this market has generally suffered from the effects of speculative construction and buying leading up to the market's peak. However, with the recent rise in California home prices, this large MSA continues to show quarterly improvement (4.2% price change), and even localized yearly gains in certain heavily distressed micro markets. Near Lake Elsinore and Canyon Lake, and in the southern limits of Riverside County lies the area encompassed by ZIP 92532. Just north of Interstate 15 with equal exposure to Corona in the north and the Murrieta/Temecula areas to the south, this micro market has managed to return a 4.5 percent price gain over the last year, making it the best performing area in both Riverside and San Bernardino Counties. While prices have been fair over the last year, this market continues to share many of the greater problems of Riverside, including highly elevated REO saturation rates that peaked near 80 percent in the fall of 2008. However, a steady demand for REOs of late has helped lift prices, while saturation rates were reduced to 55.6 percent. In northern San Bernardino County, outside the basin and in the desert, lies Helendale (ZIP 92342) -- the worst performing market area in the MSA. Isolated from economic centers, this rural area has seen prices change -33.9 percent this past year, and an astonishing -71.5 percent since the market peak. The abundance of inexpensive land in this area helped drive speculative development prior to the housing run-up, pushing prices upward to the extent that they more than tripled from 2000 to 2006. Unfortunately, hopes of establishing an owner base between Victorville and Barstow never materialized amidst weak employment opportunities and long commutes. Clear Capital Home Data Index™ Methodology The Clear Capital Home Data Index (HDI) provides weighted paired sales, and price-per-square-foot index models that use multiple sale types, including single-family homes, multi-family homes and condominiums. These models are combined with an address-level cascade to provide sale-type-specific analysis for thousands of geographic areas across the country. The indices include both fair market and institutional (real estate owned) transactions. They also provide indicators of REO activity such as REO discount rates, REO days on market and REO saturation. The Clear Capital HDI generates indices in patent pending rolling quarter intervals that compare the most recent four months to the previous three months. The rolling quarters have no fixed start date and can be used to generate indices as data flows in, or at any arbitrary time period. About Clear Capital Clear Capital (www.clearcapital.com) is a premium provider of data and solutions for real estate asset valuation and risk assessment for large financial services companies. Our products include appraisals, broker-price opinions, property condition inspections, value reconciliations, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date and well documented valuation data and assessments. The Company's customers include 75 percent of the largest U.S. banks, investment firms and other financial organizations. Legend Address Level Cascade -- Provides the most granular market data available. From the subject property, progressively steps out from the smallest market to larger markets until data density and statistical confidence are sufficient to return a market trend. Home Data Index (HDI) -- Major intelligence offering that provides contextual data augmenting other, human-based valuation tools. Clear Capital's multi-model approach combines address-level accuracy with the most current proprietary home pricing data available. Metropolitan Statistical Area (MSA) -- Geographic entities defined by the U.S. Office of Management and Budget (OMB) for use by Federal statistical agencies in collecting, tabulating, and publishing Federal statistics. Paired Sales Model -- Weighted linear model based on repeat sales of same property over time. Price Per Square Foot (PPSF) Model -- Median price movement of sale prices divided by square footage over a period of time -- most commonly a quarter. Real Estate Owned (REO) Saturation -- Calculates the percentage of REOs sold as compared to all properties sold in the last rolling quarter. Rolling Quarters -- Patent pending rolling quarters compare the most recent four months to the previous three months. The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.

Contact Information: Media Contact: Michelle Sabolich Atomic PR for Clear Capital 415.593.1400