TRUCKEE, CA--(Marketwire - October 7, 2010) - Clear Capital (www.clearcapital.com), a premium provider of data and solutions for real estate asset valuation, investment and risk advisement, today released its monthly Home Data Index™ (HDI) Market Report with the most current home pricing data available (through September 2010).

Report highlights include:

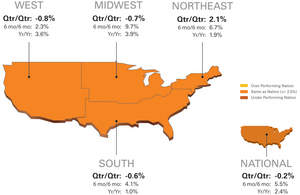

- National / Four Region Overview: Nationally, quarter-over-quarter home prices dip into negative territory (-0.2%). All four regions did retain their year-over-year price gains, but this slowdown appears likely to mark an early onset to the typically weaker markets of fall and winter.

- Metropolitan Statistical Area (MSA) drilldown: A home pricing slowdown was broadly felt even among the highest performing major markets, as quarterly price gains deteriorated in fourteen of the fifteen markets compared to last month's report. All 15 of the lowest performing major markets experienced negative quarterly price changes for the first time since June. REO saturation rates in these lowest performing markets are rising, up 2.9 percentage points on average over last month's report.

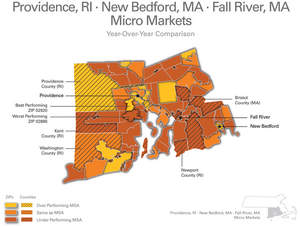

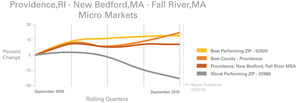

- Micro Market Analysis: After large price declines between 2006 and 2009, the Providence, R.I. MSA has rebounded to enjoy a 9.7 percent increase in home prices this year. Cranston (ZIP 02920) outperformed the rest of this MSA, experiencing a 13.2 percent gain in home prices, while Warwick (ZIP 02886) experienced a -20.7 percent price change, making it the worst performing market in the area.

"Compared to the softening quarterly gains we saw last month, the latest results of our Home Data Index indicate a substantial price correction has taken place in many major markets," said Dr. Alex Villacorta, Senior Statistician, Clear Capital. "With the effects of the recession still being felt by home buyers and sellers, the lack of demand is causing strong markets to lose their upward momentum, while sending weak markets into double dip territory. National prices are still 10 percent above their 2009 lows, so the risk of new record lows this year remains small."

"The recent halt of foreclosures by the top mortgage servicers will certainly help to slow the rate of new distressed inventory on the market, but any positive effect this will have on the market will be countered by the traditional winter slowdown that seems to be starting early this year," added Dr. Villacorta.

National/Four Region Market Overview (Sept. 2009 - Sept. 2010)

Home Prices Remain Volatile

- Nationally, quarter-over-quarter home prices dip into negative territory (-0.2%).

- The Midwest, South and West regions all returned negative quarterly price changes.

- The national REO saturation rate trended up a modest 1.1 percentage point to 23.2%.

The mix of uninspiring economic conditions and weak post tax credit demand contributed to renewed price volatility, with shorter-term quarter-over-quarter changes swinging downward at the national level from last month's 5.7 percent gain to this month's -0.2 percent change. All four regions retained their year-over-year price gains, but this slowdown appears likely to mark an early onset to the typically weak markets of fall and winter.

The current rolling quarter-over-quarter snapshot offers a good comparison between purchases made during the tax-credit program to the transactions made after the end of tax credit program. While home prices are now accompanying the downward trend in sale volumes, the effects on distressed and fair market segments of the market have been roughly the same. Even though the national REO saturation rate did trend upward 1.1 percent from last month's report, this is a modest increase in light of the larger price movements. Historically, REO saturation rates peaked in the first quarter of 2009 at 41 percent but have since descended to the current 23.2 percent level. With several of the largest mortgage servicers currently halting foreclosures, REO saturation rates are likely to continue to drift lower in the near term. The lack of overall demand, however, will prevent any significant reductions in the overall saturation. In the long term, it's probable the current moratoriums will add to the backlog of distressed inventory, ultimately placing more pressure for REOs to be released into the market.

Metro Markets (Sept. 2009 - Sept. 2010)

Single-Digit Gains Indicate Seasonal Slowdown

- The double digit quarterly price gains experienced in most of last month's highest performing major markets were replaced by single digit gains.

- Midwest markets of Cleveland, Ohio; Milwaukee, Wis.; Detroit, Mich.; and Chicago, Ill.; as well as the southern market of Memphis, Tenn., experienced the largest slowdowns (in excess of 10 percentage points) in quarterly price growth.

- Northeast markets fared better than those in the Midwest, with an average reduction of 4.1 percentage points in their quarterly gains.

- The average REO saturation rate for the highest performing major markets markets edged up 1.1 percentage points over last month's report.

The home pricing slowdown from the federal tax credit highs was broadly experienced among the highest performing major markets, as quarter-over-quarter price gains deteriorated in fourteen of the fifteen markets compared to last month's report (Houston, Texas, was the exception).

With the federal tax credit concluded, these markets are correcting some of the gains that came with the rush to purchase under that program and are settling back to pre-taxcut conditions. The Midwest and South regions contain lower-priced homes more susceptible to incentives, so we are likely to see greater effects; while the higher-priced East and West regions should see more muted movements.

All Markets Back in Negative Territory

- All 15 markets on this list experienced a negative quarter-over-quarter price change for the first time since June's report.

- REO saturation moved upward in these markets, rising 2.9 percentage points on average over last month's report.

- Tucson and Phoenix, Ariz., Atlanta, Ga., and Las Vegas, Nev. once again remained among the top ten lowest performing markets, and continue to face large (on average 44%) and growing (up 4.0% on average from last month) REO saturation rates.

- California markets dropped from the lowest performing major markets list, not due to great performance, rather the dismal price changes in markets outside the West.

With the growing number of markets now showing a downturn in home prices, REO saturation is moving upward as well. In markets where REO saturation influences are returning, prices are likely to suffer disproportionately from the national trend in upcoming months -- possibly pushing these markets into double-dip territory.

Note the return of quarterly price volatility has moved all five California markets (Riverside, San Diego, Fresno, Los Angeles, and Sacramento) listed last month up and out of this set. This is consistent with the more stable results Western markets have experienced over the last two months. Further, the seven California markets considered for our highest and lowest performing markets lists (including San Francisco and San Jose), averaged a 0.0 percent quarterly price change and an 8.6 percent yearly price gain.

Micro Markets (Sept. 2009 - Sept. 2010)

This section highlights a single market every month with a deeper dive into how the micro- and macro-markets relate to each other.

- The Providence, New Bedford, Fall River MSA experienced year-over-year home price change of 9.7%.

- Cranston (ZIP 02920) outperformed the rest of this MSA, posting a 13.2 percent price change this past year, while Warwick (ZIP 02886) experienced a -20.7 percent year-over-year price change, making it the worst performing micro market in the area.

Following home price gains leading up to the November 2009 tax credit, the Providence MSA has remained relatively stable over the last nine months. With prices up 9.7 percent for the year, residents in much of this market are likely to feel some relief following the 52.1 percent decline in prices that occurred from mid 2006 to early 2009. REO saturation has also fallen during this period, currently at 13.5 percent.

As home prices fell over the past three years, homebuyers have found some of the surrounding suburban areas an attractive alternative to downtown areas. An example of this is in the western portion of the suburb of Cranston (ZIP 02920). Cranston, the best performing ZIP code in this MSA, has experienced a 13.2 percent yearly gain in home prices and currently has a 11.4 percent REO saturation rate. As prices declined 37.4 percent from the market peak in late 2005 to today, this largely residential area has grown attractive, boasting easy access to Interstate 95 and Interstate 295. While the higher-priced segment of this market (homes over $217,500) has missed out on these recent gains, the moderate-to-lower-priced segment has benefitted from the recent tax credits as buyers look outside the downtown area for affordable deals.

Conversely, just south of Cranston lies the suburb of Warwick (ZIP 02886). Sandwiched to the north by the airport and to the south by Greenwich Bay, this area maintains almost double the REO saturation rate (20.3%) of Cranston. Warwick also experienced a -20.7 percent price change in home prices over the last year, making this area the worst performing market in the Providence MSA. Local real estate experts report home sales in Warwick are suffering due to more desirable nearby locations. Warwick is also farther from downtown, close to the airport, and scattered with light industrial complexes. The southern area of Warwick near the bay has also faltered partly because the area, historically attractive to second home-buyers, is proving less marketable given the current economic conditions and recent incentives geared toward primary residences.

About the Clear Capital Home Data Index (HDI) Market Report

The Clear Capital HDI Market Report offers the industry, investors and lenders the most recent look at pricing conditions, not only at the national and metropolitan level, but within local markets as well. Patent pending rolling quarter technology significantly reduces the multi-month lag time associated with other indices to help investors, loan servicers and individual buyers and sellers make more informed, timely and profitable decisions. Clear Capital data is built on the most recent data available from recorder/assessor offices, and then further enhanced by adding the Company's proprietary market data for the most comprehensive geographic coverage available.

Clear Capital Home Data Index™ Methodology

The Clear Capital Home Data Index (HDI) provides weighted repeat sales, and price-per-square-foot index models that use multiple sale types, including single-family homes, multi-family homes and condominiums. These models are combined with an address-level cascade to provide sale-type-specific analysis for thousands of geographic areas across the country. The indices include both fair market and institutional (real estate owned) transactions. They also provide indicators of REO activity such as REO discount rates, REO days on market and REO saturation. The Clear Capital HDI generates indices in patent pending rolling quarter intervals that compare the most recent four months to the previous three months. The rolling quarters have no fixed start date and can be used to generate indices as data flows in, or at any arbitrary time period.

About Clear Capital

Clear Capital (www.clearcapital.com) is a premium provider of data and solutions for real estate asset valuation and risk assessment for large financial services companies. Our products include appraisals, broker-price opinions, property condition inspections, value reconciliations, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date and well documented valuation data and assessments. The Company's customers include 75 percent of the largest U.S. banks, investment firms and other financial organizations.

Legend

Address Level Cascade -- Provides the most granular market data available. From the subject property, progressively steps out from the smallest market to larger markets until data density and statistical confidence are sufficient to return a market trend.

Home Data Index (HDI) -- Powerful analytics tool that provides contextual data augmenting other, human-based valuation tools. Clear Capital's multi-model approach combines address-level accuracy with the most current proprietary home pricing data available.

Metropolitan Statistical Area (MSA) -- Geographic entities defined by the U.S. Office of Management and Budget (OMB) for use by Federal statistical agencies in collecting, tabulating, and publishing Federal statistics.

Repeat Sales Model -- Weighted linear model based on repeat sales of same property over time.

Price Per Square Foot (PPSF) Model -- Median price movement of sale prices divided by square footage over a period of time -- most commonly a quarter.

Real Estate Owned (REO) Saturation -- Calculates the percentage of REOs sold as compared to all properties sold in the last rolling quarter.

Rolling Quarters -- Patent pending rolling quarters compare the most recent four months to the previous three months.

The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.

Contact Information:

Media Contact:

Michelle Sabolich

Atomic PR for Clear Capital

415.593.1400