MELVILLE, NY--(Marketwire - May 10, 2011) - FONAR Corporation (NASDAQ: FONR), today announced its earnings for the third quarter of fiscal 2011, ended March 31, 2011. The Company has net income for the past four quarters and net income from operations for the past five quarters.

Statement of Operations Items

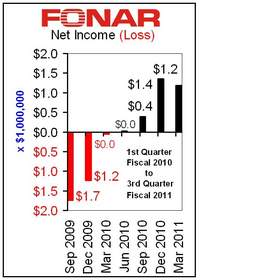

For the quarter ended March 31, 2011, net income was $1.2 million and income from operations was $1.4 million. This is compared to the same period ended March 31, 2010, when the net loss was $8,000 and income from operations was $25,000. (For a Chart visit: www.fonar.com/news/051011.htm).

For the nine months ended March 31, 2011, net income was $2.9 million as compared to a loss of $3.0 million for the nine-month period ended March 31, 2010.

Total revenues increased 15% to $8.7 million for the three-month period ended March 31, 2011, from $7.5 million for the corresponding quarter which ended one year earlier on March 31, 2010. Total revenues for the nine months ended March 31, 2011 were $25.4 million, as compared to the nine months ended December 31, 2010, one year earlier, when net revenues were $23.2 million.

Total operating costs and expenses decreased 3% from $7.5 million for the quarter ended March 31, 2010 to $7.3 million for the quarter ended March 31, 2011.

Revenues from product sales were $1.9 million for the fiscal quarter ended March 31, 2011 as compared to $2.0 million for the corresponding quarter ended March 31, 2010. Revenues from service and repair fees were $2.8 million for the fiscal quarter ended March 31, 2011 and the fiscal quarter ended March 31, 2010. FONAR's principal product is the UPRIGHT® Multi-Position™ MRI.

Significantly, revenues from the management and other fees segment (management of the ten FONAR UPRIGHT® Multi-Position™ MRI diagnostic imaging centers segment) increased 46% from $2.7 million for the three months ended March 31, 2010, to $4.0 million for the three-month period ended March 31, 2011.

Balance Sheet Items

As of March 31, 2011 total current assets were $17.0 million, total assets were $26.4 million, total current liabilities were $24.3 million, and total long-term liabilities were $2.8 million.

As of March 31, 2011, total cash and cash equivalents and marketable securities were $2.4 million as compared to $1.3 million as of June 30, 2010.

As of March 31, 2011, the total stockholder's deficiency was $781,000 as compared to a total stockholder's deficiency of $5.8 million as of June 30, 2010, an improvement of $5.0 million.

NASDAQ Continued Listing

On October 14, 2010, the Company received a notice of non-compliance from The NASDAQ Stock Market, LLC, based upon NASDAQ Marketplace Listing Rule 5550(b)(1) which requires a minimum stockholders' equity requirement of $2.5 million for continued listing on The NASDAQ Capital Market. A hearing was held on March 17, 2011, and subsequently the NASDAQ Hearings Panel granted the Company an extension until May 11, 2011 to complete a newly proposed financing and regain compliance with the stockholders' equity requirement of $2.5 million.

The Company commenced a private placement of equity and succeeded in raising $6 million by May 2, 2011, which amount was more than sufficient to eliminate the stockholders' deficiency of $781,000 as of March 31, 2011 and achieve compliance with the stockholders' equity requirement of $2.5 million.

Significant Highlight

As of March 31, 2011, FONAR has now installed 150 FONAR UPRIGHT® Multi-Position™ MRIs. The 150th was installed in Hamburg, Germany during the recent quarter. It is the fourth UPRIGHT® MRI installed in Germany by Medserena, AG. At the time of the sale, Matthias Schulz, CEO of Medserena, said, "The first three UPRIGHT® Multi-Position™ MRI centers have had great success. With physicians all over Germany asking about this technology, it has become imperative for us to expand and install a fourth FONAR UPRIGHT® MRI scanner. This is in spite of an intensely active MRI market in Germany, where there are already many conventional lie-down MRIs installed.

"The large number of requests coming from our physicians in Germany," said Mr. Schulz, "are arising because of the special medical need for FONAR's unique technology. "The German people tend to recognize the potential of any new technology quickly. We have been very successful in Germany with the FONAR UPRIGHT® MRI and its power for scanning patients in multiple UPRIGHT® and recumbent positions because our physicians have quickly appreciated the benefits of this new technology and want their patients to have access to those benefits as soon as possible.

"With 50% of MRIs being of the spine, it is self-evident that to make a satisfactory imaging diagnosis of the spine, the spine needs to be supporting its normal weight load which the conventional lie-down MRI does not permit. We firmly believe that the FONAR UPRIGHT® Multi-Position™ MRI will become a standard for MRI diagnostics in Europe, especially in evaluating the spine."

Management Commentary

"We are proud that we have now accomplished one year of solid profitability," said Raymond Damadian, M.D., president and chairman of FONAR Corporation. "Our total net income for these last four quarters was approximately $3 million and is among the most profitable one year periods in the Company's history."

"At this time, all of the segments of our business are strong. Significantly, the management of the ten UPRIGHT® Multi-Position™ MRI centers has given us steady profitability that we can rely on regardless of the state of our economy. A major reason for our profitability has been the cost-control measures that we have taken and which continue to yield results. We are pleased with our accomplishments and plan to continue capitalizing on building a strong business and increasing shareholder value," said Dr. Damadian.

About FONAR

FONAR was incorporated in 1978, making it the first, oldest and most experienced MRI company in the industry. FONAR introduced the world's first commercial MRI in 1980, and went public in 1981. Since its inception, nearly 300 recumbent-OPEN MRIs and 150 UPRIGHT® Multi-Position™ MRI scanners worldwide have been installed. FONAR's stellar product line includes the Upright™ MRI (also known as the Stand-Up™ MRI), the only whole-body MRI that performs Position™ imaging (pMRI™) and scans patients in numerous weight-bearing positions, i.e. standing, sitting, in flexion and extension, as well as the conventional lie-down position. The FONAR UPRIGHT® MRI often sees the patient's problem that other scanners cannot because they are lie-down only. The patient-friendly UPRIGHT® MRI has a near zero claustrophobic rejection rate by patients. As a FONAR customer states, "If the patient is claustrophobic in this scanner, they'll be claustrophobic in my parking lot." Approximately 85% of patients are scanned sitting while they watch a 42" flat screen TV. FONAR is headquartered on Long Island, New York.

For investor and other information visit: www.fonar.com

UPRIGHT® and STAND-UP® are registered trademarks and The Inventor of MR Scanning™, Multi-Position™, pMRI™, Dynamic™, Full Range of Motion™, True Flow™, The Proof is in the Picture™, Spondylography™, Spondylometry™ Landscape™, CSP™ and Upright Radiology™ are trademarks of FONAR Corporation.

This release may include forward-looking statements from the company that may or may not materialize. Additional information on factors that could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange Commission.

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(000's OMITTED)

ASSETS March 31, June 30,

2011 2010

(UNAUDITED)

Current Assets: --------- ---------

Cash and cash equivalents $ 2,354 $ 1,299

Marketable securities 33 28

Accounts receivable - net 6,577 4,821

Accounts receivable - related parties - net 30 -

Medical receivables - net 2 25

Management fee receivable - net 3,033 2,569

Management fee receivable - related medical

practices - net 1,755 1,922

Costs and estimated earnings in excess of

billings on uncompleted contracts 601 277

Inventories 2,192 2,826

Advances and notes to related medical

practices - net - 83

Current portion of notes receivable 190 272

Prepaid expenses and other current assets 246 553

--------- ---------

Total Current Assets 17,013 14,675

--------- ---------

Property and equipment - net 4,034 2,109

Notes receivable - net 229 -

Management agreement - net 504 -

Other intangible assets - net 4,009 4,291

Other assets 565 554

--------- ---------

Total Assets $ 26,354 $ 21,629

========= =========

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(000's OMITTED)

LIABILITIES AND STOCKHOLDERS' DEFICIENCY March 31, June 30,

2011 2010

(UNAUDITED)

Current Liabilities: --------- ---------

Current portion of long-term debt and capital

leases $ 2,148 $ 579

Current portion of long-term debt-related party - 88

Accounts payable 2,356 3,192

Other current liabilities 8,151 8,065

Unearned revenue on service contracts 6,748 5,220

Unearned revenue on service contracts -

related parties 27 -

Customer advances 4,693 4,813

Billings in excess of costs and estimated

earnings on uncompleted contracts 188 2,743

--------- ---------

Total Current Liabilities 24,311 24,700

Long-Term Liabilities:

Accounts payable 115 63

Due to related medical practices 230 528

Long-term debt and capital leases, less current

portion 1,982 1,567

Long-term debt less current portion-related party - 72

Other liabilities 497 475

--------- ---------

Total Long-Term Liabilities 2,824 2,705

--------- ---------

Total Liabilities 27,135 27,405

--------- ---------

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(000's OMITTED, except share data)

March 31, June 30,

LIABILITIES AND STOCKHOLDERS' DEFICIENCY 2011 2010

(continued) (UNAUDITED)

--------- ---------

STOCKHOLDERS' DEFICIENCY:

Class A non-voting preferred stock $.0001 par value;

453,000 and 1,600,000 shares authorized at

March 31, 2011 and June 30, 2010, respectively;

313,451 issued and outstanding at March 31, 2011

and June 30, 2010 - -

Preferred stock $.001 par value; 567,000 and

2,000,000 shares authorized at March 31, 2011

and June 30, 2010, respectively;

issued and outstanding - none - -

Common Stock $.0001 par value; 8,500,000 and

30,000,000 shares authorized at March 31, 2011

and June 30, 2010, respectively; 5,480,958 and

4,985,850 issued at March 31, 2011 and

June 30, 2010, respectively; 5,469,315 and

4,974,207 outstanding at March 31, 2011

and June 30, 2010, respectively 1 1

Class B Common Stock $.0001 par value; 227,000 and

800,000 shares authorized at March 31, 2011 and

June 30, 2010, respectively; (10 votes per share),

158 issued and outstanding at March 31, 2011 and

June 30, 2010 - -

Class C Common Stock $.0001 par value; 567,000 and

2,000,000 shares authorized at March 31, 2011 and

June 30, 2010, respectively; (25 votes per share),

382,513 issued and outstanding at March 31, 2011

and June 30, 2010 - -

Paid-in capital in excess of par value 173,122 172,379

Accumulated other comprehensive loss (15) (19)

Accumulated deficit (174,339) (177,271)

Notes receivable from employee stockholders (117) (191)

Treasury stock, at cost - 11,643 shares of common

stock at March 31, 2011 and June 30, 2010 (675) (675)

Non controlling interests 1,242 -

--------- ---------

Total Stockholders' Deficiency (781) (5,776)

--------- ---------

Total Liabilities and Stockholders' Deficiency $ 26,354 $ 21,629

========= =========

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(000's OMITTED, except per share data)

FOR THE THREE MONTHS ENDED

MARCH 31,

---------------------

2011 2010

REVENUES --------- ---------

Product sales - net $ 1,855 $ 1,955

Service and repair fees - net 2,769 2,778

Service and repair fees - related parties - net 55 55

Management and other fees - net 2,726 1,738

Management and other fees - related medical

practices - net 1,249 988

--------- ---------

Total Revenues - Net 8,654 7,514

--------- ---------

COSTS AND EXPENSES

Costs related to product sales 1,392 1,353

Costs related to service and repair fees 792 566

Costs related to service and repair

fees - related parties 16 11

Costs related to management and other fees 1,768 1,338

Costs related to management and other

fees - related medical practices 616 703

Research and development 453 528

Selling, general and administrative 2,064 2,708

Provision for bad debts 175 282

--------- ---------

Total Costs and Expenses 7,276 7,489

--------- ---------

Income From Operations 1,378 25

Interest Expense (128) (66)

Interest Expense - Related Party - (21)

Investment Income 64 51

Interest Income - Related Party - 2

Other (Expense) Income (61) 1

--------- ---------

Income (Loss) Before Non Controlling Interests 1,253 (8)

Net Income - Non Controlling Interests (69) -

--------- ---------

NET INCOME (LOSS) - Controlling Interests $ 1,184 $ (8)

========= =========

Net Income (Loss) Available to Common Stockholders $ 1,099 $ (8)

========= =========

Net Income Available to Class C Common Stockholders $ 21 $ N/A

========= =========

Basic Net Income (Loss) Per Common Share $ 0.21 $ (0.00)

========= =========

Diluted Net Income (Loss) Per Common Share $ 0.20 $ (0.00)

========= =========

Basic and Diluted Income Per Share-Common C $ 0.05 N/A

========= =========

Weighted Average Basic Shares Outstanding 5,345,349 4,929,752

========= =========

Weighted Average Diluted Shares Outstanding 5,472,853 4,929,752

========= =========

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(000's OMITTED, except per share data)

FOR THE NINE MONTHS ENDED

MARCH 31,

---------------------

2011 2010

REVENUES --------- ---------

Product sales - net $ 6,303 $ 6,479

Service and repair fees - net 8,111 8,163

Service and repair fees - related parties - net 165 165

Management and other fees - net 7,195 5,212

Management and other fees - related medical

practices - net 3,584 2,613

License fees and royalties - 585

--------- ---------

Total Revenues - Net 25,358 23,217

--------- ---------

COSTS AND EXPENSES

Costs related to product sales 5,265 5,289

Costs related to service and repair fees 2,158 2,485

Costs related to service and repair

fees - related parties 44 50

Costs related to management and other fees 4,789 3,989

Costs related to management and other

fees - related medical practices 1,988 2,208

Research and development 1,060 2,159

Selling, general and administrative 6,192 9,042

Provision for bad debts 606 659

--------- ---------

Total Costs and Expenses 22,102 25,881

--------- ---------

Income (Loss) From Operations 3,256 (2,664)

Interest Expense (359) (235)

Interest Expense - Related Party (4) (40)

Investment Income 160 203

Interest Income - Related Party 1 9

Other (Expense) Income (53) 35

Loss on Note Receivable - (350)

--------- ---------

Net Income (Loss) Before Non Controlling Interests 3,001 (3,042)

--------- ---------

Net Income - Non Controlling Interests (69) -

NET INCOME (LOSS) - Controlling Interests $ 2,932 $ (3,042)

========= =========

Net Income (Loss) Available to Common Stockholders $ 2,720 $ (3,042)

========= =========

Net Income Available to Class C Common Stockholders $ 53 $ N/A

========= =========

Basic Net Income (Loss) Per Common Share $ 0.53 $ (0.62)

========= =========

Diluted Net Income (Loss) Per Common Share $ 0.51 $ (0.62)

========= =========

Basic and Diluted Income Per Share-Common C $ 0.14 N/A

========= =========

Weighted Average Basic Shares Outstanding 5,169,253 4,917,990

========= =========

Weighted Average Diluted Shares Outstanding 5,296,757 4,917,990

========= =========

Contact Information: Contact: Daniel Culver FONAR Corporation Tel: 631-694-2929 Fax: 631-390-1709 http://www.fonar.com