LOS ANGELES, CA--(Marketwired - Apr 10, 2017) - For the first time, digital marketers can see how specific verticals have allocated their native investments throughout recent years. Nativo, the leading native advertising technology platform, today announced the results of a landmark study examining native advertising spending from Q1'2014 through Q4'2016. Nativo's Business Intelligence team analyzed ad spend across their entire marketplace, identifying key trends from major verticals such as Automotive, Travel, CPG, Health & Fitness, Finance and Insurance, Tech (both B2B and B2C), Entertainment, and Food and Beverage.

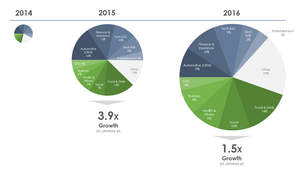

The report asserts that overall, native spend is on the rise: across all verticals in Nativo's marketplace, spend increased by 600% from 2014 to 2016. This further validates eMarketer's recent projections that by 2018, marketers plan to lean further into native -- US native ad spend will reach more than $28 billion.

But beyond the broader positive outlook for native, never before had ad spend trends been broken down by specific verticals. The industry only had access to vertical trends anecdotally. To provide digital marketers with insightful benchmark data, Nativo analyzed three years of native ad spend on their signature True Native (in feed, click-in native ad units) and Native Video formats. Results reveal markedly different ad spend trends by vertical.

Key vertical findings from the three-year study include:

- Year over year, Food & Drink grew their share of native ad spend the most by 9%. Food & Drink is followed by Travel and Business, which both grew their share by 4%.

- Automotive (OEM), Tech B2B, Entertainment, Tech B2C and Finance and Insurance, all early adopters of native advertising in 2014, saw their aggregate share of budget decline by 20%, from 57% in 2014 to 37% in 2016.

- Conversely, slower vertical adopters of native -- Business, CPG, Travel and Food & Beverage -- grew by 24% to reach 45% aggregate share of budget in 2016.

- Combining all related campaigns (OEM, After-Market, etc.), Automotive remains the most active vertical year over year.

- Top performing verticals in terms of engagement include CPG, Entertainment, Travel, Food & Drink, and Tech B2C.

"Native spend continues to grow rapidly overall, but beneath that linear trajectory we've witnessed a lot of fluctuations vertical to vertical," said Casey Wuestefeld, Vice President, Campaign Operations at Nativo. "The data indicates that while advertisers are committed to increasing their investment in native, they are still experimenting where content strategies fit within their overall marketing mix."

To learn more about Nativo's vertical ad spend study, contact sales@nativo.com.

About Nativo

Nativo is the leading advertising technology platform for brand advertisers and publishers to scale, automate, and measure native ads. For brands, Nativo is the ultimate content advertising platform that combines automation and insights with high quality reach to scale and optimize engagement with brand content. For media companies, Nativo provides a complete native technology stack that makes it easy to sell, deploy, and optimize native ads across their media properties expanding their revenue potential while delivering a better, non-interruptive experience for their audiences.

More than 600 brands and 400 publishers leverage Nativo's platform to power their next-generation digital advertising. Learn more at www.nativo.com.

Contact Information:

Media Contact

Nikki Reyes

WIT Strategy for Nativo

408-499-0033

nreyes@witstrategy.com