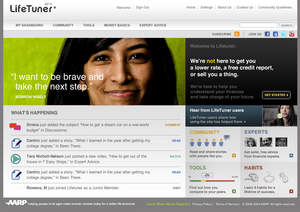

-- 57% of young Americans consider their financial situation to be the biggest concern in their lives. -- 66% rate their own financial situation as fair to poor, and almost half (43%) expressed concerns about their ability to make sound financial decisions. -- Nearly eight out of ten young people (78%) have debt of some kind. Credit card debt (36%) -- considered "bad debt" by most financial experts -- is by far the most prevalent form. -- 68% of respondents admit that finances have caused stress in a relationship or friendship. -- While in many cases social media sites (e.g. Facebook) have lowered or eradicated the social boundaries around certain topics, finances remain a taboo subject. In fact, people are more likely to discuss relationship status (61%), politics (43%), their health (23%), and their weight (20%) than their financial situation. -- Among those young adults who have sought advice online, 85% report being more confident about their ability to manage their finances.These findings demonstrate the need for LifeTuner.org, a new online community brought to you by AARP. This online community offers unbiased, balanced resources, information and financial advice to young adults. By providing free expert advice alongside an interactive community of their peers, LifeTuner makes personal finance accessible and inclusive. LifeTuner provides a series of tools and calculators designed to help balance budgets, itemize spending and pay down debt. The site also includes "8 habits" for long-term financial health; simple, easy-to-follow rules that show how anyone can start building their financial future. The creation of LifeTuner will also benefit existing AARP members in a multitude of ways. For example, the aforementioned research found that a majority (60%) of respondents view their parents as their primary source of financial advice. Additionally, a prior survey of AARP members found that 69% were still providing some level of financial support to their adult children. Additionally, LifeTuner provides AARP members a way to give back by sharing their life lessons and experiences through LifeTuner's "Been There" forum, which encourages an intergenerational dialogue around finances, career and other money-related life concerns. "The findings of this report perfectly illustrate the reasons why LifeTuner was created," said Diane Ty, AARP Senior Vice President. "We worked closely with over 400 young adults who helped us shape the vision and content of LifeTuner. Our aim is to demonstrate to young adults that many of the financial decisions made in their 20s and 30s, particularly those around saving for the future and avoiding harmful debt, can affect the rest of their lives." LifeTuner is working with The American Institute of Certified Public Accountants (AICPA) and the Certified Financial Planner Board of Standards (CFP Board), which are encouraging their members to join the LifeTuner community as volunteer experts. "The AARP and the AICPA Feed the Pig campaign share an important goal: to remind tomorrow's younger Americans that long-term financial security begins today, when they are busy establishing their place in the world," said Jordan Amin, CPA and chair of the AICPA's National CPA Financial Literacy Committee. "LifeTuner is a welcome addition to all of us working to increase all Americans' financial literacy." "With the country still feeling the effects of the economic downturn, now is the time for everyone -- regardless of financial status or acumen -- to re-evaluate their approach to money management," said Eleanor Blayney, CFP®, Consumer Advocate at CFP Board. "Young adults are a key factor of this equation and our membership is extremely excited about joining and supporting LifeTuner's effort." LifeTuner, which is currently in open beta, is freely accessible to the public at www.LifeTuner.org. Key findings and a full copy of the report are available here. Survey Methodology The survey was conducted by Greenberg Quinlan Rosner from August 29-September 10, 2009, using a multi-modal design that included cell phone, random-digit-dial landline, and online samples. About AARP AARP is a nonprofit, nonpartisan membership organization that helps people 50+ have independence, choice and control in ways that are beneficial and affordable to them and society as a whole. AARP does not endorse candidates for public office or make contributions to either political campaigns or candidates. We produce AARP The Magazine, the definitive voice for 50+ Americans and the world's largest-circulation magazine with over 33 million readers; AARP Bulletin, the go-to news source for AARP's nearly 40 million members and Americans 50+; AARP Segunda Juventud, the only bilingual U.S. publication dedicated exclusively to the 50+ Hispanic community; and our website, AARP.org. AARP Foundation is an affiliated charity that provides security, protection, and empowerment to older persons in need with support from thousands of volunteers, donors, and sponsors. We have staffed offices in all 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

Contact Information: Contact: Alejandra Owens Office: (202) 434-2560 Email: asowens@aarp.org Monica Appelbe LEWIS PR for LifeTuner Office: (415) 992-4400 Email: lifetuner@lewispr.com