BOSTON, MA--(Marketwired - Nov 19, 2013) - Massive oversupply and downward price pressure have created the misconception that the solar industry suffered from industry-wide commoditization. But not all solar modules are created equal, and profit margins can rise to double-digits for select enabling materials -- even as overall materials sales volumes grow at a compound annual growth rate (CAGR) of 9.2% through 2018, according to Lux Research.

While materials such as frontsheet glass, polysilicon and ethylene vinyl acetate have the lowest profit margins, certain gases, metals, polymers, and process chemicals and solvents maintain double-digit margins. In fact, since mid-2009 solar materials have seen steadily increasing profit margins, with the exception of glass and polysilicon.

"While certain solar materials are commodities, many others still offer opportunity for differentiation and high margins through added performance," said Fatima Toor, Lux Research Analyst and the lead author of the report titled, "Photovoltaic Materials Opportunities Beyond Commoditization." "Innovations in high-performance encapsulants, backsheets and metallization pastes enable higher profitability by allowing module makers to improve efficiency and command higher prices," she added.

Lux Research analysts examined key trends in solar materials technology and the IP landscape, and analyzed how these innovations affect profitability. Among their findings:

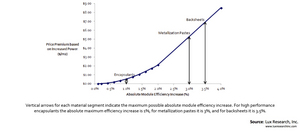

- The right materials can drive higher efficiency. Innovative solar materials can have a dramatic effect on module efficiency. For example, high-performance encapsulants can enhance module efficiency by up to 1% absolute, while innovative backsheets can improve module efficiency by up to 3.5% absolute and improved metallization pastes by 3% absolute.

- High impact materials can capture high profit materials. When materials boost module efficiency, they can command higher prices due to the value of increased power output to project developers. Lux Research compared materials on a 2x2 based on their impact on module performance and their profit margins. Encapsulants, backsheets and metallization pastes figured in the upper right hand quadrant, reflecting high impact and high profitability.

- DuPont leads in patents for solar encapsulants. In an analysis of solar materials IP, DuPont leads in IP for solar encapsulants with 87 granted or applied patents. Dow Corning, LG Chem and Dai Nippon Printing lead in silicone-based encapsulants; Dow Chemical holds IP for liquid acrylic encapsulants; BASF's key IP is on UV stabilizers for EVA- and non-EVA based encapsulants.

The report, titled "Photovoltaic Materials Opportunities Beyond Commoditization," is part of the Lux Research Solar Components Intelligence service.

About Lux Research

Lux Research provides strategic advice and ongoing intelligence for emerging technologies. Leaders in business, finance and government rely on us to help them make informed strategic decisions. Through our unique research approach focused on primary research and our extensive global network, we deliver insight, connections and competitive advantage to our clients. Visit www.luxresearchinc.com for more information.

Contact Information:

Contact:

Carole Jacques

Lux Research, Inc.

617-502-5314

carole.jacques@luxresearchinc.com